|

Airlines utilize exorbitantly expensive flight equipment, with costly support operations and commercial activities. This makes evaluating resource requirements particularly difficult. Slightest

miscalculations result in huge cost penalties and long-lasting impacts. Yet, for airlines determined to succeed, understanding resource needs is a vital element in stepping towards

future success.

Choosing the right investments to maximize the airline’s position in the ever-changing marketplace is not a trivial task. The risks associated with resource investments, coupled with market

uncertainties, shift the actual project benefits away from the nominal values.

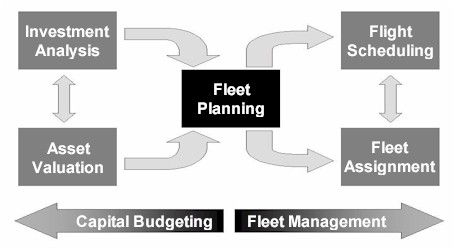

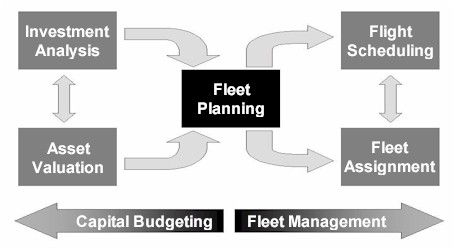

Strategy-based capital budgeting and fleet management is a rational methodology to optimize the portfolio of capital projects and investments. It addresses

both organizational and analytical issues. Capital decisions are then tied to the airline’s long-range business direction. And, sensible economic analyses of

opportunities provide realistic expectations for project benefits.

Well-designed capital budgeting processes incorporate the following key issues, missing from traditional approaches:

» Many interrelated projects

» Uncertain outcomes

» Multiple objectives

Whether your airline is considering adding a new hub or restructuring the current ones, planning to increase the fleet size and/or aircraft types, or

entering new markets with the existing fleet, your airline can substantially enhance the quality of capital budgeting decisions by incorporating advanced

analytical methodologies and leading-edge investment decision techniques. This can be done through a structured approach as illustrated below:

|

Download Fleet Management and

Download Fleet Management and

Download Fleet Management and

Download Fleet Management and